Do you make short-term or long-term decisions?

Short-term decisions regarding your business can be short-sighted, impulsive, and detrimental to the growth of your brand.

Long-term decisions are more thoughtful, focused, calculated and help grow brands—but often require a great deal of patience.

Wall Street is full of people who make emotional short-term decisions based on the daily, weekly or monthly performance of stocks. This is in direct contrast to what we know about stock market performance and behavior—that it is a long-term game.

That’s what makes the development of a new stock exchange called The Long-Term Stock Exchange so unusual. The basic idea: List companies that don’t report or react to earnings on a quarterly basis. Its mission is to bring together companies that are looking at the long-term picture.

Sanjay Bakshi, Managing Partner at ValueQuest Capital, subscribes to this philosophy. In fact, after he found a beginners guide to buying shares and learned the trade, he stopped looking at Yahoo and Bloomberg because it was too much noise. Not only does he not look at stock prices or buy shares every day, he doesn’t even look at quarterly financial statements. While Bakshi says you should look at earnings each year, the real value is looking at long-term performance.

Warren Buffett’s Berkshire Hathaway holds losing companies too long according to many financial analysts and fails to cut their losses. But their goal is to build the Berkshire Hathaway image as a long term player. By not dumping a loser, it reinforces its brand as being a long-term holder of value and thus attracts businesses to sell or invest with them precisely because of that image or reputation.

Doesn’t reacting to short-term results with short-term thinking sound like another industry you may be familiar with?

Misinterpretation of Nielsen ratings is a perfect example of how radio companies fall into the trap of short-term thinking. When quarterlies become monthlies then become weeklies and now even dailies, it is incredibly tempting to make decisions based on “the latest book.”

What if radio station managers adopted the long-term view of Bakshi and Berkshire Hathaway?

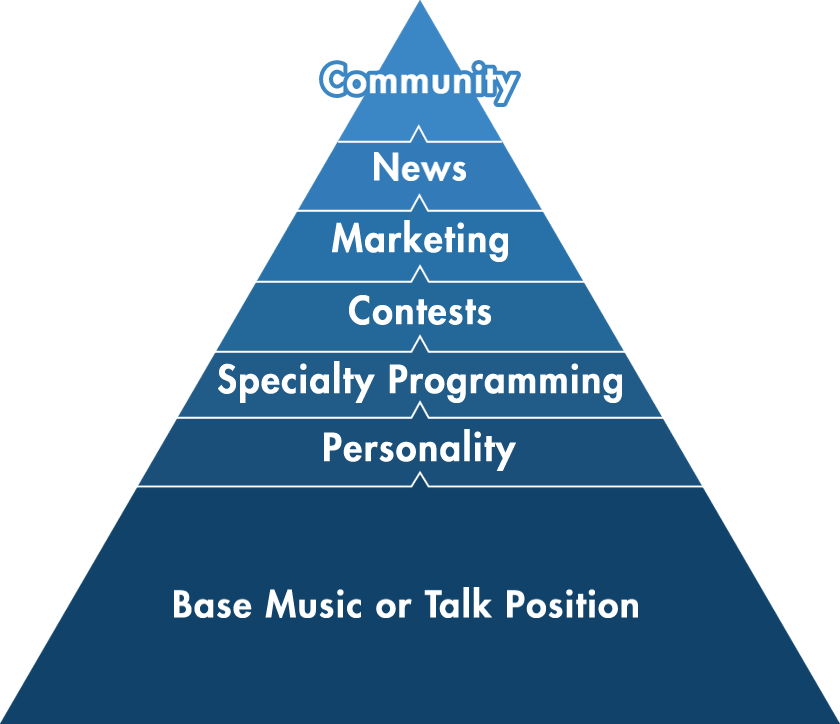

Programming strategy is a long-term proposition. There is no way to “game” the system just to deliver ratings this month or quarter. That isn’t how it works. Ratings are built upon a long-term bond with your audience. Every day, every way, you build a relationship, a positive image in their minds, and they will come back to your station over and over and deliver long-term ratings as well. That’s why we spend time with our clients on building their Image Pyramid—fortifying their base position then building brand depth.

The Coleman Insights Image Pyramid

Does every song you play today matter? Of course it does. Every song is a marketing decision, as we like to say. But it is the sum of many decisions over a long period of time involving layers of the Image Pyramid including music, personalities, marketing and specialty programming that add up to a brand, an image, that will serve your station for years to come.

From the long-term perspective, does it make sense to look at Nielsen ratings every week or month and make decisions based upon that small timeframe? We think not. Look at six months or a year of ratings to identify a real trend.

Think strategically, execute based on that strategy, then give that strategy time to take hold. Research and refine the strategy.

Over time, we think you’ll find long-term vision and planning is far better for your brand (and your mental state) than short-term decisions based on “today’s news.”

Excellent article. What do you do when management doesn’t do anything? Stays put on the heritage reputation of the station? Doesn’t pay attention to trends that have proven they have lasted over a period of time? Basically, the “same ole, same ole” attitude. Frustrating.