This is the story of a once-dominant radio station that did everything right.

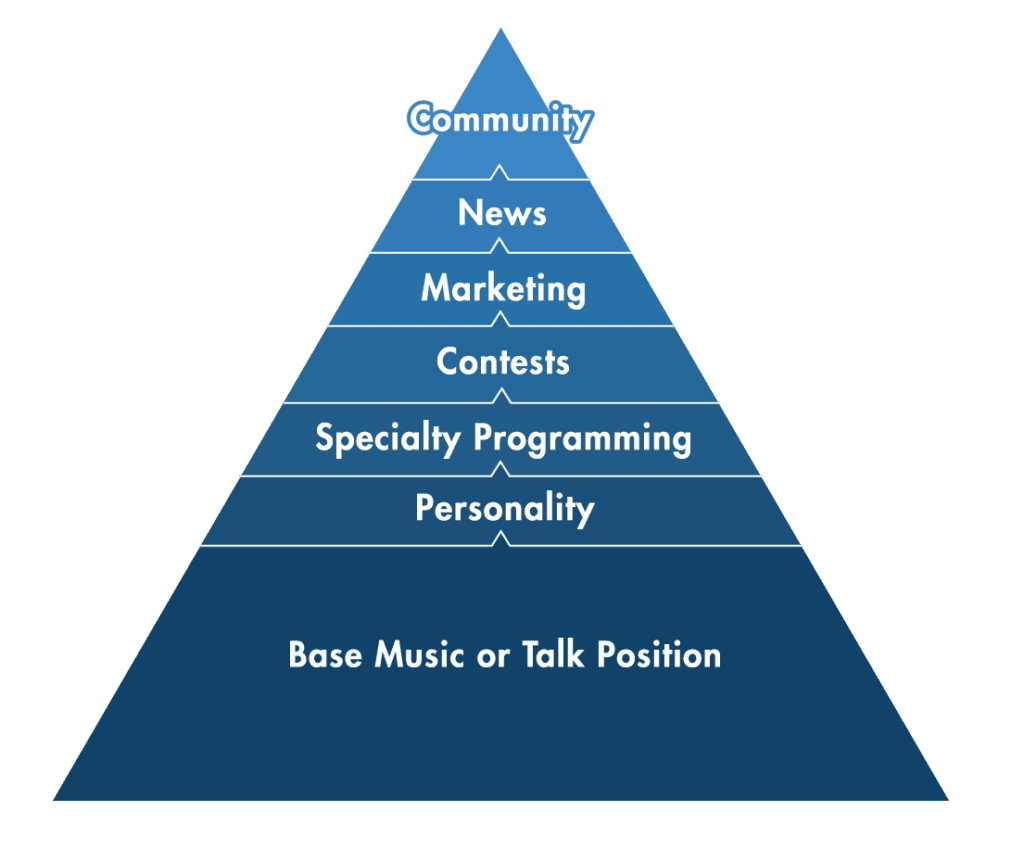

The owners deployed a perceptual research (Plan DeveloperSM) study on the brand every single year to ensure its market position was the most optimal one. It had an enviable Image PyramidSM: a strong Base Music Position, a dominant morning show that complemented the brand, and deep images that permeated the community.

The Coleman Insights Image Pyramid

Because this station consistently fielded research, we saw things that were not obviously there. Ratings were great. Revenue was great. But there was trouble brewing, and we could identify it early.

For obvious reasons, we can’t share identifying information such as the market, station, and personalities, but we invite you to take a look back at the progression of studies done for this brand over a nearly fifteen year period to get a clearer glimpse of how the process works–and how valuable perceptual research can be.

At one time, our client station was in an outstanding position. Their perceptual research looked very strong. It was strongly associated with its desired music images and the morning show was the dominant leader in the market. In fact, in the early stages of research, our morning show was growing with Cume and P1 listeners and there were few signs of weakness.

Then a new competitor launched. It wasn’t the first time our station had fended off competitors. If ratings and revenue were the measure of success, the client station was still in an outstanding place. The new competitor was on a weak signal, which limited its potential. But early on, despite what ratings showed, the morning show on the new competitor displayed positive early indicators in our research. And, despite what the ratings said, we saw the first signs of image erosion with our show.

About a year later, it was clear the crosstown morning show showed impressive promise with the younger end of our target demographic. We recommended attempting to acquire the other morning show.

Eleven months later, our morning show still performed well in the ratings, but there was a clear disconnect with the younger end. At this point, our station had a far stronger Base Music Position and in fact the competitor’s base position was weakening. But their morning show was growing and was wildly popular among their P1s. Their show was not performing to its potential because that station’s Base Music Position was weak. Again, we recommended making a play for the other show.

A year later, the weakness of our competitor’s music position continued to hamper their morning show, which lacked familiarity in the market. But the show was outperforming our show perceptually on the younger end. We believed, particularly because of its weak music position, getting this show would be devastating to the other station. We once again recommended going after it.

Another year later: We insisted a morning show change needed to be made. The host of the other show had been given the time needed to develop into a superstar. Our show’s fan base was now significantly older than the target of our station. But by this point, making a pitch for their show was getting out of reach.

Two years later: Our station’s perceptual position had eroded. Cume Conversion (the percentage of listeners that convert into loyal P1s) plummeted. Momentum images were concerning, with a high number of listeners that felt our station was “not as good as it used to be.” By this point, our morning show was replaced, but it was too late–and the new morning show was not a good fit and had high negative images.

Three years later: The competitor was now the preferred station in our target demographic. The other show was in syndication.

The station has arguably never recovered, going through a variety of format shifts and talent lineups while the competitor continues to thrive.

Every good researcher will tell you that their job isn’t to tell you what you want to hear–it’s to tell you what you need to hear, as we did here. And fortunately, we often get to deliver good news–but hearing bad news can be immensely valuable. It would be easy to say, “Why didn’t they just make the change??”…but of course it’s more complicated than that, including money issues and people issues. It’s hard to pull the trigger on something when ratings and revenue show things are going well.

By deploying strategic research, you get to see things that aren’t immediately obvious. You get to make the decisions that can have remarkable impacts on your brand. It’s certainly better than relying on ratings and gut alone.

No, the job is to persuade the client to take the action.

Jon,

A great pitch here explaining the value of research. It’s very obvious that you know the right questions to ask, but coming up with the answers can’t always be so easy. You say the client station’s morning show was “dominant” – but the new competitor was gaining ground? Why ? What was the client station’s morning show doing that left them suddenly vulnerable ? Your suggestion to “steal” the competitor’s morning show doesn’t say what to do with the existing show. Throw it out? If it was once dominant, there must be value to the existing foundation that was built for (at least 3) years. Should the introduction of a competing morning show be the reason to eliminate the client’s current show? That’s not a cheap proposition when you realize you have severance, legal, marketing and perception issues.

When a competitor emerges, you can assume there will be some attrition but it’s also an opportunity to examine the client’s position in the market and how to fix it. In 2020 the answer today is not to blow it up and start over. Companies are treating talent like outdated software and to offer up the suggestion to “steal the competition’s morning show” is along those same lines.

I’m reminded of a station that did just what you suggested – replace their current morning show by stealing the competition’s show. They did- and after the initial spike the “new” show tanked. The former morning show was moved to the company’s FM and struggled. The dynamics of both stations were totally disrupted when a properly executed research project (in my opinion) could find a much more suitable way of building on the station’s existing foundation. If they were big once, they can be again without blowing it up and starting over. Let’s keep the people and the station image in mind as well! Thanks for giving us something to think about though. I hope you can expand on this whole problem and how you developed the solution.

Dave, those are all great questions. I have answers for most of them, though not all. I felt that it was beyond the scope of this blog to get into that much depth. However, a couple of my answers to a couple of your questions.

First, the morning show on the client station was dominant, but aging. We knew there were issues subjectively, but the research showed how valuable they were, particularly to 25 to 44 year old listeners. The new show was targeted younger and at a different life group. Our idea was to steal the morning show on the competitor and reposition our morning show as an afternoon show.

The client decided not to change shows and tried to freshen their “”aging” show. That may have made it worse.

The other option they considered was to age the station and build it around the appeal of the morning show.

None of the choices was perfect or easy. They were between a rock and a hard place.

Thanks for writing and thanks for your comments

It’s a tough situation in any situation, Jon. I appreciate your answers and the fact that you were going to keep the existing morning show. Your success in research knows no limits and you’ve done very well-and I’m sure part of that success has to do with your ability to see more than side of the story, and offer viable solutions. An existing once dominant brand once it is “dethroned” is a tough one to turn around. We can’t control what the competition is going to do – we have to plow forward and do the best we can with what we have . I enjoy reading your insights