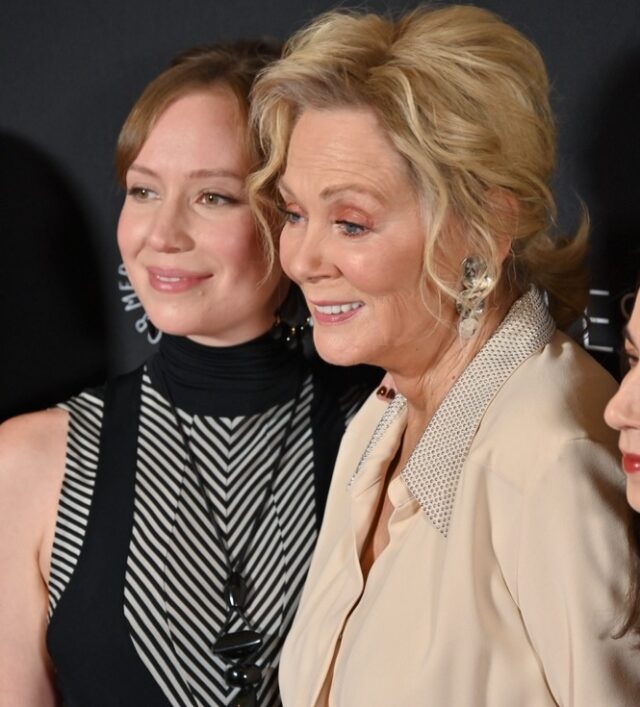

Last Thursday’s episode of the Max series Hacks, starring the incredible Jean Smart as comedian Deborah Vance and Hannah Einbinder as her writer/sidekick/frenemy Ava Daniels, hit different for me. After decades of toiling in Las Vegas and not getting the widespread love and recognition she deserves, Deborah Vance is named the first female host of her own late night talk show. The show gets off to a great start as viewers check out Late Night With Deborah Vance, with the first two episodes in the honeymoon period of initial sampling.

Hannah Einbinder and Jean Smart from the Max series Hacks (Photo credit: Michael Mattes / Shutterstock.com)

An in-person focus group is quickly conducted, which is encouraging until two women mention they don’t like Deborah’s hair up. Then the network research guy comes to the staff meeting to let the team know the show is overperforming with men, as well as “middle-aged Black business owners, gay dads under 50, college-educated Singaporeans, and retired divorcees in the Great Lakes region.”

The bad news? 25- to 45-year-old women don’t like Deborah. The show has already fallen to fourth place, and this demo that’s highly appealing to the network is necessary for its advertising goals.

Ava’s response is to tell Deborah that data should be used as a tool, not their guiding principle. Deborah’s initial response is to change the show completely. Instead of a show built on the sarcastic, snarky, hilarious observations Deborah is known for, it morphs into one that shows her adding long hair extensions, a cooking segment (Deborah may not have personally cooked a meal in her life), and an attempt to get Kristen Bell on as a guest (who is very popular with the 25-45 Female target).

In Hacks, Kristen Bell tests well with 25- to 45-year-old women. (Photo credit: Tinseltown / Shutterstock.com)

Ultimately, at the end of the episode, the interpretation of research lands somewhere closer to the middle, where it should be. Ava was right in that research is a tool and should not have been used to fundamentally change Deborah. Deborah Vance doesn’t look any more in place hosting a cooking segment than Howard Stern looked in place hosting a Country show at WWWW/Detroit in 1981 as “Hopalong Howie.”

Kayla, one of Deborah and Ava’s talent agents, has a different interpretation of the research. She shows her partner, Jimmy, a viral TikTok video of “Dance Mom” who the show initially passes on featuring. At the end of the episode, Deborah brings on “Dance Mom,” who gets Deborah to dance with her, looks like she’s having a blast, and the audience goes crazy. The content is clearly appealing to the demo they seek, but it doesn’t feel like Deborah (who was seen dancing at a gay bar earlier in the episode) is off brand.

Can the show evolve? Will it work? We’ll see.

This fictional episode, with touches of my reality, is an important reminder that research without proper interpretation and insight is just numbers in a spreadsheet. Truly valuable and actionable research considers a wide spectrum of factors, from brand and talent to execution.

If truly conducted properly, the head of research would have explained what the research means and offered ideas. No changes would have been made until Deborah and Ava agreed on a clear, outlined strategy with specific steps.

But sometimes, in reality as in fiction, it’s easier said than done.

Here are three market research takeaways from Hacks:

- You can conduct research too soon. Go back and watch the first episodes of Seinfeld and you might be shocked it turned into one of the greatest shows in history. Like many shows, the characters and story needed time to develop.

- Great brands are a combination of art and science. My favorite baseball team, the San Francisco Giants, went overboard on analytics a few years ago and few players got consistent playing time, constantly rotating them in based on statistics. That’s not fun for the players, the fans, or brand building. Trust the data, but also trust yourself to bring it to life. Smart brand managers also trust their gut. You can do both if it’s strategic.

- Be authentic. Our research shows the strongest personalities have clear brands that resonate with their audiences. Data can guide your strategy, but it should never change who you are.