Why would a company want to launch a branded podcast?

For starters, it’s a unique form of outreach to add to a marketing plan. Relative to a more standard advertising campaign, a branded podcast can be a cost-efficient way for a company to provide content that grows its image and supports the values of the respective brand.

Inside Trader Joe’s is often referred to as the gold standard of branded podcasts. It has a large and loyal following because the content of the podcast matches the perception and expectations of the brand. Trader Joe’s has a cultish following, with an army of shoppers that are more than happy to spread the gospel of Mandarin Orange Chicken, “Unexpected” Cheddar Cheese, and Steamed Pork and Ginger Soup Dumplings. Shopping at Trader Joe’s feels like you’re part of some secret society.

Photo credit: Pamela Brick / Shutterstock.com

So, what’s the podcast about?

Inside Trader Joe’s peels back the curtain on how they make the brand so special. There’s an episode about the bells the workers ring. There’s one about how the store sets its prices. What’s up with those mini tote bags? Why do they use private labels? Why don’t they offer online shopping?

Much of the population won’t care about this content. It’s wonky stuff, after all. But for someone into Trader Joe’s, it’s gold. It has the vibe of what you’d probably expect from a Trader Joe’s podcast, answers questions their consumers would likely care about, and it all carefully supports and builds the brand’s image.

Trader Joe’s is hardly the only company producing a branded podcast.

The Bank of New York has Your Active Wealth. There’s Space Makers by Lockheed Martin. Toyota Untold by Toyota. The list goes on and on.

One of the best things about podcasting is that anyone can do it. So, no matter the size or type of company, a branded podcast could make sense.

But in some ways, branded podcasts present land mines that other podcasts don’t. Your podcast represents your brand. And just as you would consider everything from the shape of the logo to which colors to use to what messaging to deploy in a standard ad campaign, a branded podcast should be handled with a high level of strategy.

Last year, I conducted a Plan Developer perceptual study for a large company with an already successful parenting advice podcast in the Kids and Family category. There were questions from some in the organization about the value of the effort it takes to produce a branded podcast. Many of the questions related to things like the talent, the topics, and the target audience.

So, what did we learn?

We learned how top-of-mind this podcast is with its target consumers. We found out which type of parenting advice is most important to them. We tested the appeal of specific titles. We discovered the hosts are very well liked. We found out that most people familiar with the brand and the podcast didn’t know that the client’s brand was behind the podcast.

That was a big finding.

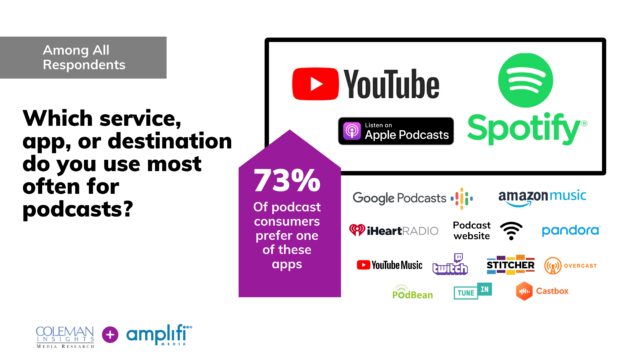

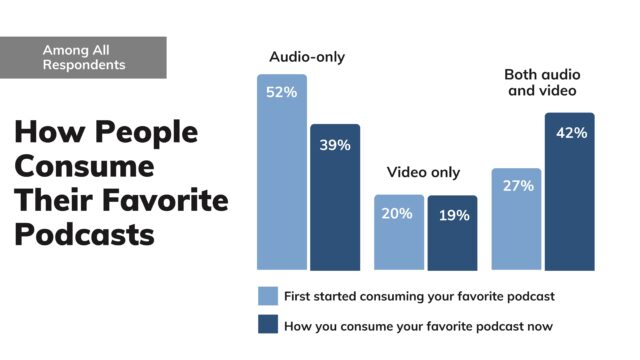

Another significant finding related to video. At the time, this podcast was only available in audio form. Half of those familiar with the brand and podcast said they’d be much more likely to listen or watch if made available via video.

At the time, the podcast was nowhere to be found on YouTube. After just a few months of consistency and YouTube’s algorithms determining who to serve it to, the video version has grown from a handful of views per episode to over 100,000 views per episode.

If you want to utilize a podcast to support your brand’s growth strategy, it is imperative that you approach it as strategically as you would with all your other marketing efforts.