Cirque Du Soleil is in trouble.

One major impact on the challenges was out of its control. When the COVID-19 pandemic shut down live shows, Cirque Du Soleil ceased operations around the world, from its traveling shows to the fixed performances in Las Vegas.

Another major impact on Cirque Du Soleil’s current struggles is maintaining relevance to younger generations. As is pointed out in this New York Times piece detailing the issue, “nostalgia” comes up often in conversations about reinventing Cirque. If you understand the history of Cirque Du Soleil, there’s something ironic and staggering about that.

Cirque Du Soleil’s “Luzia” show (Photo credit: Christian Bertrand/Shutterstock)

The innovator is trying to figure out how to innovate.

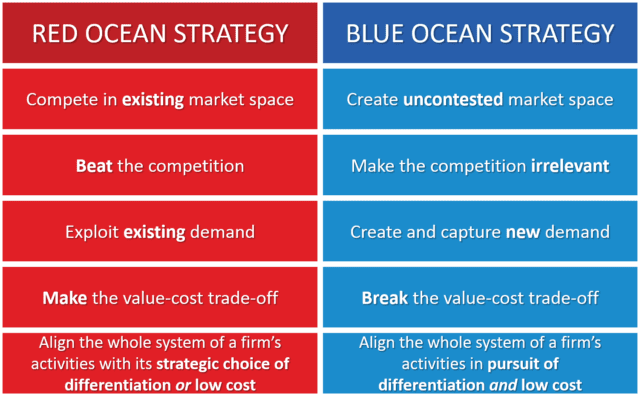

Cirque Du Soleil is a literal poster child of Blue Ocean Strategy, which focuses on building advantages over the competition by competing in uncontested space. The wide-open category (“Blue Ocean”) is often preferable to the shark-infested waters of brands competing for the same market share (“Red Ocean”).

Cirque mastered Blue Ocean Strategy by redefining what a circus was. Ringling Bros. and Barnum & Bailey were old, outdated, silly, sad animals, discounted. Cirque Du Soleil was new, fresh, unique, massively skilled acrobats instead of animals, premium.

It worked for a very long time.

The pandemic inspired Cirque to hire Cultique, a “cultural analysts” firm that’s in the business of helping businesses stay ahead of the curve. Cirque Du Soleil is now chasing (re)-relevance by brand extension. You can now buy the Cirque du Soleil Tycoon Roblox video game. It’s working on a documentary, a convention, and lots of new merch. By finding new sources of revenue in new markets, Cirque hopes it can reinvent itself and not rely almost exclusively on live show revenue.

The founders of Cultique say they don’t rely much on data, because they believe once they show up in surveys, it’s too late. And when you’re in the business of capitalizing on the hot trend of the moment, there’s certainly truth to that.

What data can tell you…and should tell you…is how relevant your brand is and what images it still owns. Far too often, brands fail to deploy strategic research to keep tabs on consumers’ perceptions and stay on the same path while they fall out of favor. Utilize research and data to stay on the pulse of your consumer so your brand is in a constant state of evolution and innovation, rather than being forced to dig out of a hole that one day may be too deep to ascend from.