This Fall marks 10 years since Arbitron rolled out the Portable People Meter™ (PPM™) to the top 10 markets in the United States, following initial tests in Houston and Philadelphia (markets 11-50 rolled out in 2009 and 2010.)

A year after the rollout was complete, I wrote “Top Ten Things to Do as a New PD in a PPM Market,” a list of strategic guidelines for new radio programmers in North American markets measured by the Portable People Meter™.

Now that much of the radio industry has lived with PPM for a decade, let’s look back on the advice through a 2018 lens. New commentary is italicized.

1. Root all of your thinking first and foremost in the strategy of the station. Don’t go in with a PPM mindset; go in with the mindset of developing a brand by exploiting an available market position. Your goal should be to develop a strong brand and to make the station entertaining and focused. Once you know “who you are” and what your brand message is and how you want to communicate that to the audience, then start thinking PPM.

Especially in the first few years of the methodology, programmers focused a significant amount of time on PPM manipulation. Maybe, just maybe, we can squeeze an extra quarter hour here and there by playing the PPM game.

10 years later, I think radio strategy has generally reverted back to where it was, with brand focus as the most important component. The PPM panel is just as difficult to manipulate. Big brands are long lasting. Manipulation tactics are not.

2. Do a complete brand and content audit of the station. Don’t go to the office for the first two days or meet with staff. Stay at home or in your hotel and listen to and quantify all the verbal and non-verbal content. How much music do you play? How much do your DJ’s and personalities talk? What do they talk about? What are the features? Promotions? How does the station stage and image its music? What is the station’s positioning and how often do you communicate it?

What we learned in our 2008 study “Real PPM Panelists Tell All” was that every interruption had some detrimental impact on the ratings. The instinctive reaction of many programmers was to wipe the station clean – 30 second promos became 10 seconds, IDs were five seconds, jocks talked less.

What’s important to understand is that interruptions, while detrimental in the moment, can be additive to the brand. So, make sure every interruption has brand value. If it builds the brand, it’s worth it.

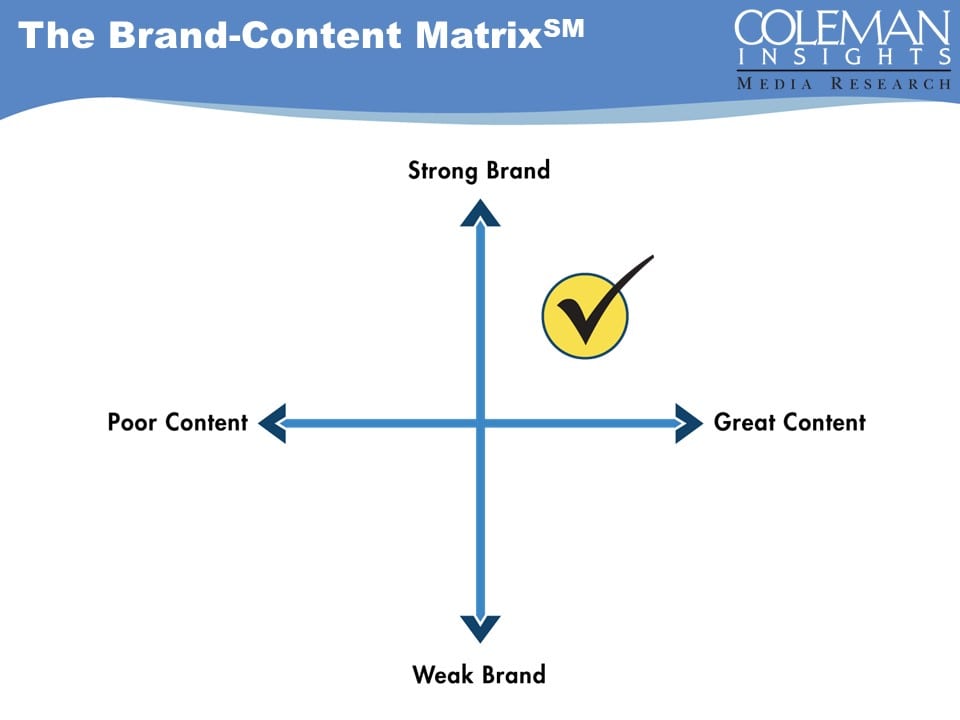

3. Rate all the content on the station on a 1-10 brand scale and a 1-10 execution scale. The brand scale means how each element on the station fits or resonates with the brand essence of the station. Does it fit with the images you want to project? Do the same with the in the moment execution. Is it entertaining? Tight? Would a listener stay tuned in that moment? Rate everything on a 1-10 scale. Anything that is low on both “brand values” and “in the moment entertainment” should be eliminated or tightened. Possible culprits might be DJ chatter that is not compelling. Sales promos. Worry less about content that supports the brand identity. Music features, entertaining DJ content from personalities who are well known and liked.

It’s always been challenging for PDs to subjectively evaluate content. In the moment, we overthink and overreact. By doing regular monitors on your stations, writing down each break and piece of content and rating it on a simple scale, it’s easy to quickly determine what’s brand additive and what isn’t.

4. Do an abbreviated analysis of your main competitors. What are they doing in music, talk, features, positioning, and spot placement? React to their programming tactics where it is smart. Know their pure programming advantages so you can cover them where it makes sense. One thing for sure is that you don’t want them to be tighter or better programmed for PPM than your station since small advantages can sometimes mean a lot when it comes to PPM performance.

Studying your competition as well as your own station is always a good idea. Prepare for your opponents like a head coach.

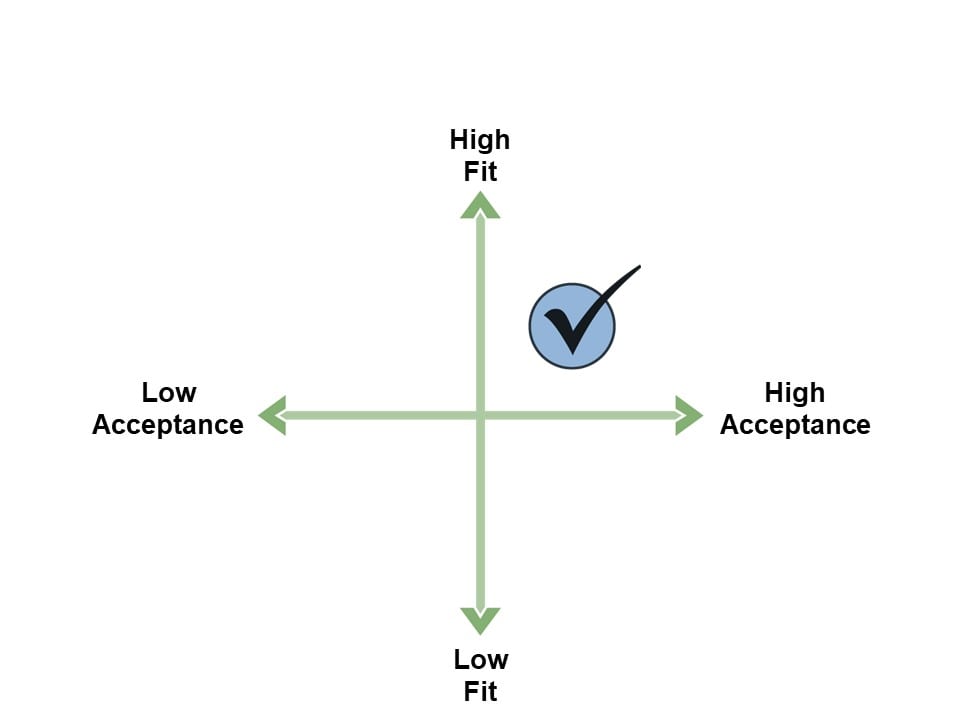

5. Don’t be afraid to put on content that will impact the audience emotionally even if in the moment you cause some tune-out. There are two ways to build ratings and one is more important than the other. First, you can put on content that causes people to like your station. Content that causes an emotional reaction and a desire to be associated with your station. Second you can reduce “tune-outs”, those things that cause people to tune away for a minute or an hour. Both are important, but you should recognize that you can impact the ratings positively even if in the moment some people tune-out. Some things that cause a little short term tune-out will actually stick in the head of your P1’s and create a long term bond. Keep the things that are a 10 on the brand evaluation scale, even if a few people tune away when you do them.

As in #2, build the brand and accept in-the-moment loss. While even the strongest content may cause tune-out, it will grow your brand and ultimately grow the audience over time.

6. Understand the ins and outs of PPM ratings, including the fact that PPM, like diary, is research and not immune to statistical wobble. Really understand margin of error and then learn how to aggregate ratings for programming elements of the station. Know the numbers behind each number you look at like the difference between looking at a daypart with 20 meters and one with 100 meters.

The difficulties reaching potential panelists, and certainly the erosion of the landline over the past 10 years, has compounded this problem. By utilizing perceptual research, like our Plan Developer, you can track essential measurements like Cume and P1 with larger sample sizes than may be available with ratings. An added benefit of perceptual research is the ability to monitor your perceptual position in the market, including your strengths, weaknesses and opportunities.

7. Understand panel dynamics so that you don’t react to ratings increases or decreases that are a function of normal panel change or evolution. Sometimes ratings will increase a little just because you have a few more P1’s in the sample as a result of panel turnover. Sometime you will lose listeners. This is normal and you need to know when it is happening to your station. Don’t over-believe the good numbers and temper your reaction to the weak ones. They will more often than not be in a statistically valid range.

This has improved over time as Nielsen has provided and added tools to better understand and get a granular look at the panel.

8. Learn how to manage weekly ratings and expectations. All ratings have wobble and fluctuations. In diary markets, most GMs and PDs know not to overreact to monthlies or even whole books. But, in a PPM world there is often a belief that weeklies and monthlies have more credence than similar ratings spans in a diary world. However, with PPM, just like any research, there is random and normal fluctuation. So, you need to be able to set the table on how to react to weeklies, monthlies and ratings in general. Tell your new GM that you don’t want to look at weeklies or discuss them each week. Don’t download them at 11am each Tuesday and make it a big event. Look at them every three or four weeks.

Fortunately, the weekly obsession does not appear to be pervasive in 2018. But there is more focus now on meter count, and there’s still the danger of focusing on too much of this at the expense of brand focus and taking your eye off the ball.

9. Understand causation vs. simple correlation. Realize that every time your ratings go up or down it is not necessarily related to that hours, days or weeks programming. Often there will be a random correlation between a programming event and ratings. More often than not, it will be just a correlation and the two events will not be causally related.

Remember that listeners are not paying close attention to your radio station. They remember events selectively and select radio stations based on habit, needs, perceptions, language and lifestyle. More often than not, a correlation from event to ratings will be by chance, not because you caused it.

10. Experiment. If you don’t know for sure what causes your ratings to go up or down, experiment to find out. For example, if your hot rotation on currents is 3 hours, go to 2.5 every other week for 20 weeks. Divide your ratings in to two 10 week periods. See if the 10 2.5 hour rotation weeks show any ratings difference from the 10 3 hour rotation weeks. Do tighter rotations work or not? Aggregate enough weeks to have a statistically valid comparison. Also, if you do this, look at other variables that might be impacted. For example, does the burn on songs change with tighter rotations? Are there fewer or more highly popular songs?

A/B testing is all the marketing buzz, though testing of messaging has been around for decades! Just as Google and Amazon test the delivery of their product, there’s no reason why radio stations shouldn’t test theirs as well. Perhaps you try variations of clocks every other day. Maybe you play 200 songs one day and 300 songs every other day. Run stopsets differently every other day. Compile a year of ratings data and compare. If you really want to get granular with Nielsen data, do it over a long enough period of time to formulate actionable plans based on that data.

10 years after the debut of PPM in the top 10 markets and seven years after writing these tips, the general principles of successful programming haven’t changed. If you’re:

- Always thinking strategically

- Staying true to your brand

- Maintaining focus and discipline

- Not overreacting

- Testing and tracking results over time

…you’re positioned for PPM success in 2018 and beyond.