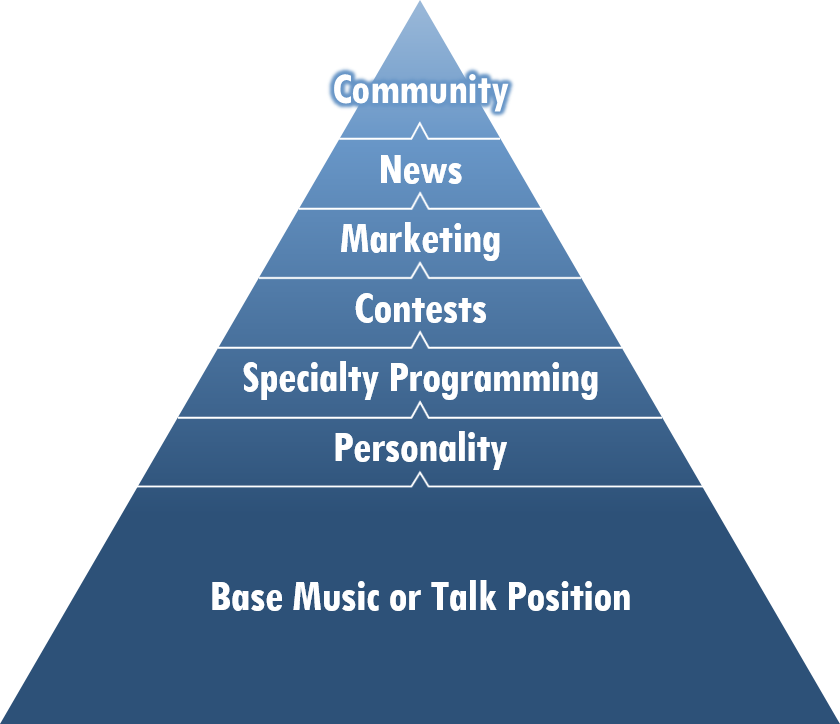

When my Coleman Insights colleagues and I consult the brands we work with, one of the biggest challenges we face is convincing a client when they need to sacrifice short-term performance for their brand’s long-term benefit. Perhaps the classic example with one of our music radio clients is when we advise them to make their brand multi-dimensional by adding layers to their station’s Image PyramidSM, often by adding a personality-driven morning show to their music station.

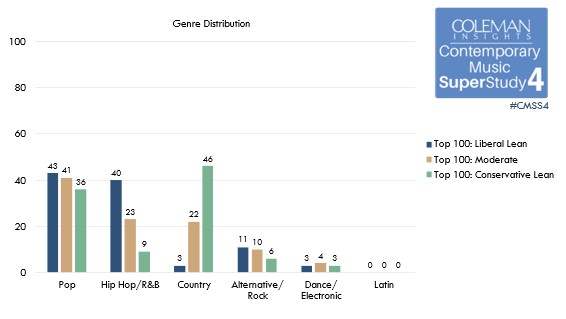

The foundation of the Coleman Insights Image Pyramid is the Base Music or Talk Position, but the most successful radio stations add multi-dimensional layers

We do this knowing that this may undermine the station’s performance in the short run, as listeners who are tuning in for the music-intensive nature of the station may be turned off by the introduction of nonmusical content. Even those listeners who enjoy morning show content may initially spend less time with the station until they get more comfortable and/or come to appreciate the content the new morning show offers.

Essentially, we are suggesting that our clients take one step back as an investment that should allow them to eventually take two steps forward. If their station becomes known for its entertaining morning show in addition to the music it offers, the station’s performance will be stronger in the long run. The process requires patience and a long commitment—especially if the station’s ratings slide downwards in the first few months after the morning show’s launch—but if the new show is truly compelling to a large number of listeners, such patience and commitment will pay off.

This type of strategic thinking applies not to just audio brands, but a wide array of businesses—those that understand that short-term performance is not necessarily a proxy for brand health are usually the most successful. A recent story I read in the New York Times about Arapahoe Basin, a Colorado ski area that tops out at 13,050 feet and offers some of the highest skiable terrain in North America, drove this point home for me.

A decade ago, Arapahoe Basin was always packed with skiers, many of whom were visiting via Epic Pass, a program that provides access to hundreds of ski areas for a full ski season. In the Times article, the resort’s chief operating officer said, “Business was fantastic—we were having record years;” in other words, Arapahoe Basin’s short-term performance was excellent.

However, their very strategic-minded COO, Alan Henceroth, also knew that skiers were leaving Arapahoe Basin dissatisfied with the crowded conditions. Lift lines were long and there were few opportunities for skiers to find solitude and peace in the otherwise spectacular setting Arapahoe Basin offered. Some days things got so bad that Arapahoe Basin did not have enough parking spots for the customers who wanted to ski there. As Henceroth told the Times, “[We] thought the brand was really being damaged and the foundation of our business was crumbling.”

How did Henceforth react? He turned away customers, undermining the resort’s short-term performance. In 2019, Arapahoe Basin left Epic Pass and instead affiliated with other multi-mountain pass programs that placed limits on the number of days pass holders could ski Arapahoe.

The result was a 69 percent decrease in the number of skiers the resort hosted by early 2020; as Henceworth proudly shared in his blog, “The experience is way up. The skier days are way down.” He also told the Times, “We are focused on creating quality of experience.” Essentially Arapahoe Basin turned away the “easy money” generated by a large number of skiers on cheap passes using its amenities; it invested in its brand and now caters to skiers who are willing to pay more for a better experience.

Today Arapahoe Basin is performing better than it ever has financially, allowing the resort to invest in modernization and upgrades. Sometimes you must step back to move forward.

Have you registered for Coleman Insights’ first Ask Me Anything webinar? It’s this Wednesday, March 1st from 2P-2:15P EST and registration is open now.