The Mexican government just wrapped up “Mexico Sings,” a first-of-its-kind national music competition designed to steer popular taste away from Narcocorridos—ballads glorifying drug cartel culture—and toward more wholesome themes. Over 15,000 contestants participated, more than 9 million people tuned in, and major record labels are now competing to sign the winners.

It’s an ambitious effort. It’s also likely doomed to fail in its larger goal.

Not because the music isn’t good—the winning songs fusing Mariachi with Hip Hop, Pop melodies, and traditional Mexican sounds may well be excellent. But because governments, no matter how well-intentioned, cannot direct cultural tastes. They never have been able to, and they never will be.

The Tipper Gore Playbook

American audiences will recognize this story. In 1985, Tipper Gore and the Parents Music Resource Center launched a crusade against explicit lyrics in popular music, targeting everyone from Prince to Twisted Sister. Congressional hearings followed. Parental Advisory labels were slapped on albums. The message was clear: this music is dangerous, and something must be done.

Photo credit: Snap Spot / Shutterstock.com

The result? Albums with advisory labels became more desirable. The artists became more popular. And the genres the PMRC sought to suppress—gangster rap, heavy metal, explicit Hip Hop—exploded in the following decade. Ice Cube, N.W.A., and 2 Live Crew didn’t fade away; they became cultural icons. The forbidden became irresistible.

Cultural prohibition rarely works as intended. Whether it’s the Mexican government promoting alternatives to Narcocorridos or American advocacy groups warning against explicit lyrics, the pattern is the same: tastes evolve organically, often in direct opposition to official guidance.

How Music Genres and Subgenres Emerge

If governments can’t engineer taste, can anyone? Not really.

Consider how musical movements emerge: Grunge came from Seattle’s underground scene, not from a boardroom strategy session. Hip Hop grew from block parties in the Bronx. Even within established genres, the breakthroughs are often unplanned. Peso Pluma’s massive hit “Ella Baila Sola”—notably, not a Narcocorrido—became one of the most popular songs in the Corridos Tumbados movement organically, not because executives predicted it would be.

Why Narcocorridos Became Popular

The Mexican Music Council director Miguel Ángel Trujillo offered an honest assessment: Narcocorridos became popular because “they reflected a harsh reality, and also because listeners dreamed of the lives of luxury depicted in the songs.”

This is the uncomfortable truth that government initiatives often miss. Music doesn’t shape culture in a vacuum—it reflects it. Narcocorridos gained traction because they spoke to real experiences and aspirations in communities affected by cartel violence and economic hardship. Banning them or creating alternatives doesn’t address the underlying conditions that made them resonate.

Several Mexican municipalities have made it a crime to play music celebrating the drug trade. Musicians like Luis R. Conriquez and Grupo Firme have announced they’ll stop performing Narcocorridos, facing fan backlash in the process. Some artists have even lost U.S. visas for their associations with the genre.

But as defenders of the music point out, banning songs doesn’t solve problems of crime and violence. It just drives the expression of those realities underground—or makes it more appealing.

The Value of Staying Connected

So if tastes can’t be manufactured or controlled, what can be done?

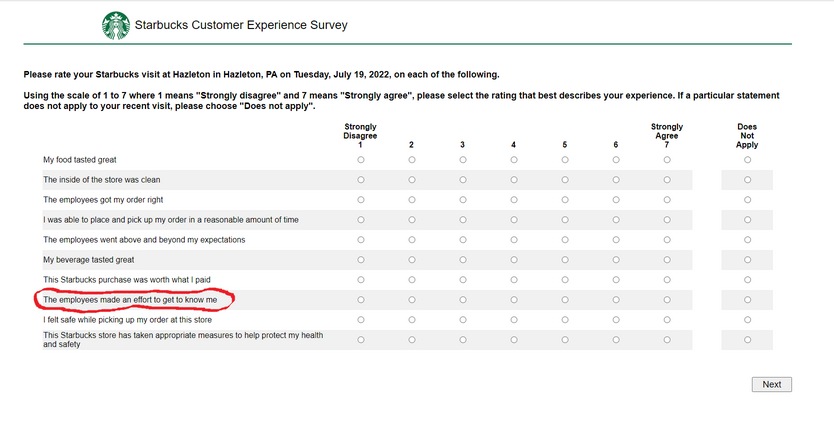

This is where research becomes invaluable.

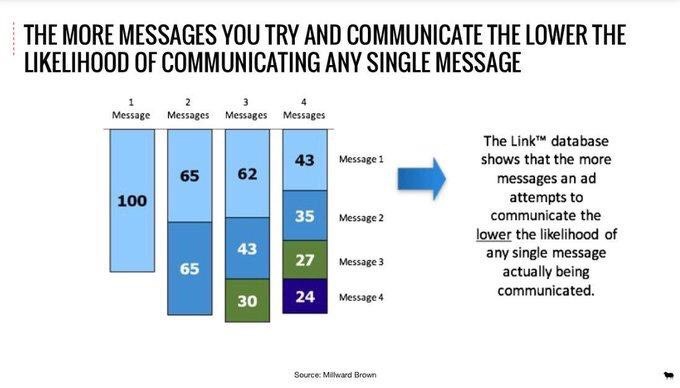

Market research can’t tell the future, but it can prevent you from losing touch with the present. It’s the difference between riding a wave and being swept away by it.

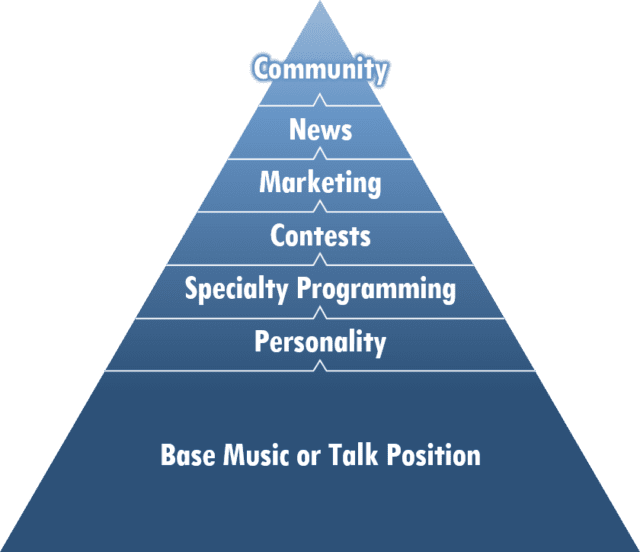

When a radio station insists on playing only the music they believe listeners should enjoy, they lose audience. When a podcaster creates content based on their own assumptions rather than listener feedback, they miss opportunities. The most successful content creators are those who remain curious about their audiences, who listen more than they lecture, and who adapt to changing tastes rather than resist them.

What “Mexico Sings” Gets Right

Despite our skepticism about its larger goals, “Mexico Sings” does something valuable: it creates opportunity and visibility for artists exploring different themes. Carmen María González, who won best song with her Pop tune, had been funding her own music career, recording in her closet and working restaurant shifts. For her and others like her, this platform is life-changing.

The competition isn’t trying to ban Narcocorridos (President Claudia Sheinbaum has actually opposed outright bans). Instead, it’s adding alternatives to the cultural conversation. That’s a fundamentally different approach than prohibition.

Mexico President Claudia Scheinbaum (L) is seeking cultural alternatives to Narcocorridos. (Photo credit: VG Foto / Shutterstock.com)

The Bottom Line

Culture is a conversation, not a decree. Musical tastes evolve through a complex interaction of social conditions, individual creativity, technological change, and pure randomness. Governments and corporations alike have discovered that this process can be influenced at the margins but never fully controlled.

The Mexican government’s effort to promote alternatives to Narcocorridos is admirable in its intent. But whether it succeeds won’t depend on how many millions of pesos are invested or how many viewers tune in to the competition. It will depend on whether the music connects with something real in listeners’ lives—something that can’t be engineered or mandated.

For those of us in the business of understanding audiences, the takeaway is clear: stay curious, stay connected, and never assume you know better than your audience what they should want. That’s not just good research practice. It’s a fundamental truth about how culture actually works.